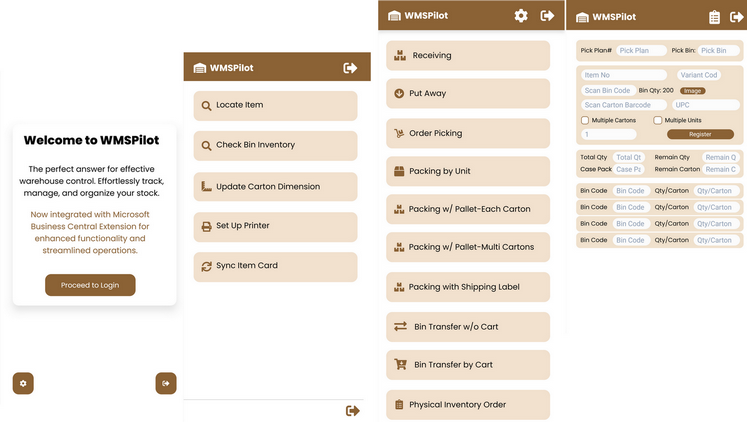

Innovative WMSPilot system

The perfect answer for effective warehouse control. Effortlessly track, manage, and organize your stock.

Optimizing ERP for Tariff Challenges

Case Study: Optimizing ERP for Tariff Management

Background

In April 2025, the latest tariff adjustments placed a heavy burden on importers, requiring businesses to quickly and efficiently update pricing structures. B2B customers needed a clear and transparent cost calculation system to make informed purchasing decisions before placing orders.

Challenge

With varying tariff rates depending on the country of origin, our client faced difficulties in maintaining accurate pricing for imported goods. They needed a dynamic pricing solution that would factor in tariffs while ensuring a seamless and automated workflow within their ERP system. Additionally, the extreme 245% tariff increase on certain Chinese imports made cost management even more critical.

Solution

Darbtek developed a customized ERP enhancement, integrating a country-specific tariff rate table directly into the system. This solution allowed:

-

Automated synchronization between product origin and applicable import duties.

-

Enhanced Sales Price List with a new base pricing field, reflecting pre-tariff costs.

-

Automated calculations updating final pricing, ensuring accuracy in quotes.

-

Seamless integration with the system’s native functions to minimize excessive customization and avoid conflicts.

-

Advanced tariff tracking for high-impact categories, including goods affected by the 245% tariff increase on Chinese imports.

Additionally, we streamlined the client’s sales website, ensuring the pricing structure matched the updated ERP calculations while maintaining transparency with customers.

Latest Tariff Changes (April 2025)

Recent tariff adjustments have significantly impacted global trade:

-

China – U.S. tariffs on specific Chinese imports jumped to 245%, making strategic pricing essential.

-

Vietnam – Tariffs increased to 46%, affecting supply chain diversification.

-

Taiwan – Taiwanese imports now face a 32% tariff, impacting the electronics and semiconductor industries.

-

Philippines – Tariff adjustments are still under review, but early reports suggest potential increases in agricultural and textile imports.

Results

-

Reduced customization risks, preserving system integrity.

-

Accelerated deployment, completing the project in 5-10 days.

-

Improved pricing transparency, allowing B2B customers to assess cost increases effectively.

-

Mitigated tariff impact, ensuring sellers could adapt to China's 245% tariff adjustment with dynamic pricing updates.

By leveraging ERP-native functionalities, Darbtek successfully provided a future-proofed pricing structure, ensuring compliance, efficiency, and cost clarity in a rapidly shifting tariff landscape